- Ethereum developers are preparing to deploy the Shanghai upgrade, or Shapella, on the Goerli testnet, the last dress rehearsal before going live on the Ethereum mainnet.

- The upgrade will allow investors to withdraw their staked ETH for the first time since Ethereum began staking with the beacon chain in 2020.

Ethereum developers are gearing up for the much-awaited Shanghai upgrade, or Shapella, to be deployed on the Goerli testnet ahead of its launch on the Ethereum mainnet. The upgrade is crucial for the Ethereum community as it will allow investors to withdraw their staked ETH for the first time since Ethereum began staking with the beacon chain in 2020.

Last month, the developers successfully implemented the Shapella upgrade on the Sepolia testnet. If today’s launch of the Shapella upgrade on the Goerli testnet is successful, the developers will proceed with its implementation on the Goerli testnet next month in April 2023. After going live on the Goerli testnet, developers are confident that they will unlock the staked ETH within three to four weeks.

The implementation of the Shapella hardfork on the Goerli testnet will be closely watched as it is the largest Ethereum public testnet. It is also the last chance for staking providers to ensure that it is possible to withdraw and unlock the staked ETH tokens before Shapella reaches the Ethereum mainnet.

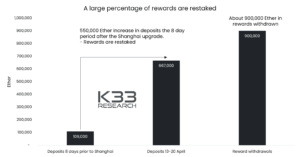

However, concerns have been raised about the potential massive supply of ETH flooding the market once investors can withdraw their staked ETH. Several crypto enthusiasts have expressed concern that this could lead to huge selling pressure on ETH, dragging its price down.

Christine Kim, VP of research at Galaxy Digital, believes that only a small percentage of validator nodes will withdraw their entire staked ETH holdings, preventing a massive supply of ETH from flooding the market. Kim explained that some validators may require liquidity from their entire staked ETH and opt for liquidity staking instead of ETH. Furthermore, the price of ETH has already declined significantly since it started staking in 2020, making it less attractive for unstaked ETH holders to sell at this point.

Despite concerns, Ethereum has seen a strong recovery trajectory this week, up 14% on the weekly chart and currently trading at $1775 with a market cap of $217 billion. Whales have also been active during the recent price correction, with ETH whales holding between 1,000 and 10,000 ETH adding 400,000 Ethereum tokens worth $600 million during the recent dip, according to on-chain data provider Santiment.

The post Ethereum Developers Prepare for Shanghai Upgrade Ahead of Mainnet Launch appeared first on .