- Ethereum’s Shanghai upgrade led to a record-breaking weekly inflow of ETH deposits for staking, mainly driven by institutional staking service providers and investors reinvesting rewards.

- The top five institutional-grade staking service providers staked a total of 235,330 ETH combined, worth around $450 million.

Record-breaking ETH deposits for staking after Shanghai upgrade

Ethereum’s Shanghai upgrade, completed on April 12, led to a record-breaking weekly inflow of ETH deposits for staking, worth over $1 billion. According to a Dune Analytics data dashboard by 21Shares, investors deposited 571,950 ETH tokens into staking contracts, the largest weekly token inflow in the history of ether staking.

The deposit surge was driven mainly by institutional staking service providers, including Bitcoin Suisse, Figment, Kiln, Staked.us, and Stakefish, who staked a total of 235,330 ETH combined, worth around $450 million.

Restaking rewards and reduced liquidity risk

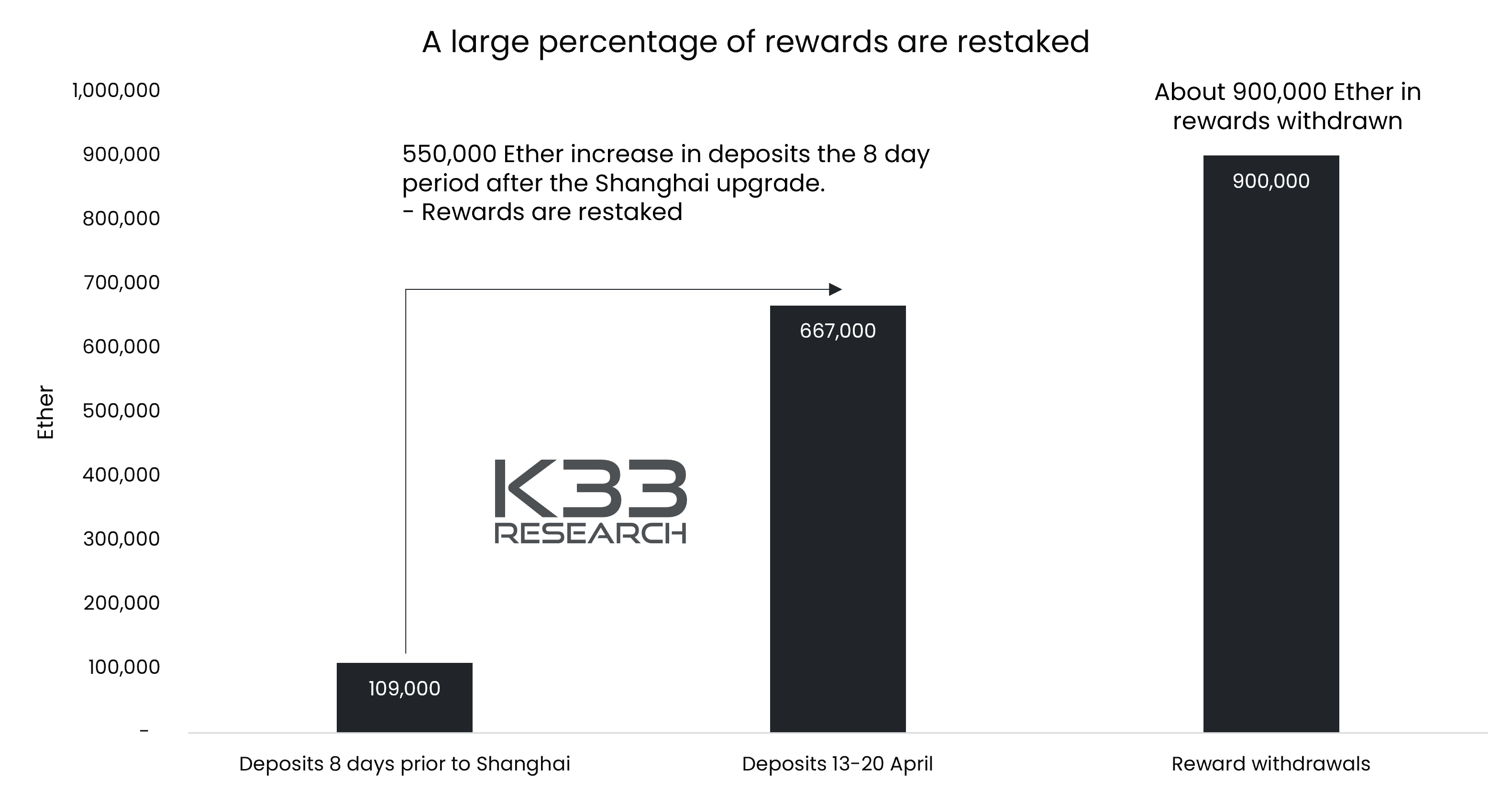

Another likely catalyst for the record inflow has been investors choosing to reinvest their previously earned and withdrawn rewards from staking. Through the first eight days after the upgrade, investors withdrew some 900,000 ETH in staking rewards, while staking deposits totaled around 667,000 tokens, indicating that investors decided to restake a large part of the withdrawn rewards.

The increased interest in ETH staking also highlights that enabling withdrawals from Ethereum’s proof-of-stake chain has significantly reduced the liquidity risk associated with locking up tokens.

In summary, Ethereum’s Shanghai upgrade led to a record-breaking weekly inflow of ETH deposits for staking, driven mainly by institutional staking service providers and investors reinvesting rewards.

The top five institutional-grade staking service providers staked a total of 235,330 ETH combined, worth around $450 million. The ability to withdraw tokens from staking contracts has significantly reduced the liquidity risk associated with locking up tokens, which has increased interest in ETH staking.

The post Ethereum’s Shanghai Upgrade Spurs Record-Breaking Inflow of ETH Deposits for Staking appeared first on ETHNews: Bringing you the news of everything blockchain, Ethereum, and the internet..