Where to listen:

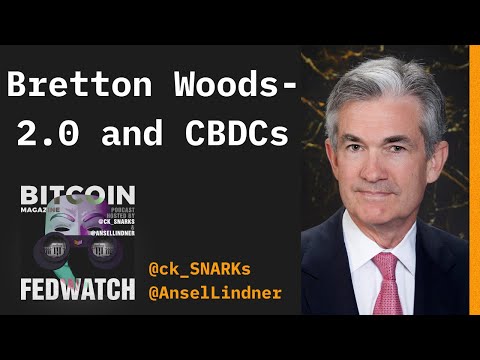

The IMF panel on cross-border payments was a Central Bank Digital Currency (CBDC) discussion in disguise, headlined by Jerome Powell, chairman of the Federal Reserve.

The CBDC narrative is the central bank version of the hype around blockchain technologies that rose from 2016 to 2018. Back in 2019, the International Monetary Fund (IMF) began dipping its toe into the CBDC idea. That naturally spread to emerging markets, where we see the majority of interest today.

In a recent episode of “Fed Watch,” CK and I try to describe the scene, breaking down a video message from Kristalina Georgieva, IMF’s managing director in Washington, DC, filmed on October 15 and titled “A New Bretton Woods Moment,” as well as the IMF panel with Chairman Powell.

Fed Watch was the first podcast or media outlet of any kind in the Bitcoin space to make this connection and start talking about a coming Bretton Woods agreement or Plaza Accord. We’ve asked all our guests in recent months about this issue. The dollar’s dominance is growing in relative terms, but is also too debt-laden to provide much, if any, growth. Since there is no better fiat alternative to the dollar, Bitcoin is showing people a better, more optimistic way forward.

We anticipated this call for a new Bretton Woods agreement, but in this episode, we point out why this statement from the IMF won’t lead to a new agreement. The U.S. and China, both important parts of the IMF, are at each other’s throats and won’t work together on a Bretton Woods-style agreement anytime soon. We are not optimistic about the possibility for an East/West Bretton Woods agreement.

Later in the episode, CK and I discussed the IMF panel on cross-border payments, which was really a panel on CBDCs. The first elephant in the room was the lack of Chinese representation on the panel. China is a big part of the IMF, and the only Special Drawing Right (SDR) member actively testing a CBDC. Its absence was noticeable.

We played audio and video of two important places where Chairman Powell speaks and throws cold water on the CBDC love fest.

The Federal Reserve is actively researching the CBDC issue. Several speeches and updates have been released over the years, and Fed Watch covered the most recent, which mirrors what Powell said on this panel. As of now, the Fed is pursuing a “wait-and-see” approach. It is keeping bridges open to key researchers in the U.S., but doesn’t have plans to do much more at this time.

Chairman Powell constantly talks about “costs and benefits” of a CBDC. It is a sober analysis that we don’t see from other central bankers. They are full steam ahead, spending millions on research and testing, convinced a CBDC is a viable new tool. On the other hand, the Fed’s position as the maintainer of the world reserve currency gives it the latitude to stand back and watch how it develops. The Fed is not willing to jeopardize its fragile monetary system to introduce an experimental central bank asset class.

The Fed does not know exactly what money is today. It gave up measuring the eurodollar in the 1980s. It isn’t sure what releasing a brand new central bank liability will do to the financial system.

As I said over a year ago, we will be able to watch central bankers learning in real-time about CBDCs, as their thinking evolves from blockchain technology, to tokens, to payments and back to bitcoin, just like everyone that evolved from blockchains back to bitcoin in 2016 to 2018.

The post Video: The Fed Considers CBDCs And Bretton Woods 2.0 appeared first on Bitcoin Magazine.