The previous crises are actually quite different from what we are currently experiencing if we examine history.

In times of extreme fear, uncertainty and doubt (FUD), Bitcoiners need FUD-busting.

In 1710, almost a decade before the South Sea Bubble in England and the Mississippi Bubble in France, the essayist and author Jonathan Swift wrote the following iconic lines, echoed by many of history’s most famous writers, about truth and lies and their effects:

“… it often happens, that if a lie be believed only for an hour, it has done its work, and there is no further occasion for it. Falsehood flies, and truth comes limping after it; so that when men come to be undeceived, it is too late, the jest is over, and the tale has had its effect.”

Little did Swift know that falsehoods reminiscent of his own era’s financial manias would reemerge again and again more than three centuries later, wielded by economists who don’t know the first thing about the monetary and cryptographic invention they are more than happy to attack.

These critics of Bitcoin often mention the South Sea Bubble, Tulip mania or the Mississippi Bubble, thinking that they hold the definitive trump card. And Bitcoiners, sometimes unfamiliar with much of financial history, object that bitcoin is not in a bubble, leading to the usual impasse that we can’t readily identify a bubble until after it has burst.

Since my academic training is in financial history, I have always found another avenue to be more fruitful: object to the analogy altogether. I know a thing or two about the episodes that Paul Krugman, Nouriel Roubini and others routinely invoke — and I don’t think they know what they’re talking about.

So let’s FUD-bust the bubble analogies and educate bitcoiners in these financial-history matters.

Latest to the party of equating Bitcoin to the iconic bubbles of the past is the European Central Bank (ECB). In its Financial Stability Review last month, it stated matter-of-factly that:

“Signs of exuberance have also been observed in the renewed interest in crypto-assets, although financial stability risks appear limited. The surge in bitcoin prices has eclipsed previous financial bubbles like the ‘tulip mania’ and the South Sea Bubble in the 1600s and 1700s.”

The footnote support for this tiresome claim was a reference to that same report from 2018 (as if nothing has happened in Bitcoin in the last three years) where we find:

“Bitcoin’s growth surpassed that of other historical bubbles before it crashed in early 2018, losing 65% of its value. [the] Market capitalisation of crypto-assets remains modest despite price developments that are more extreme than those of historical bubbles.”

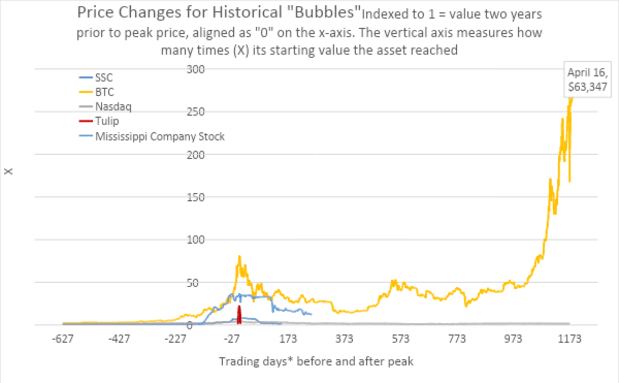

This is followed by an apparently incriminating graph that I re-create below. Of course, if the criteria for qualifying for the bubble hall of fame are nothing but large and rapid increases in asset prices, plenty of candidates exist,from the recent history of some of today’s dominant tech companies to your average pink sheet listed venture.

Graphically, it looks like the ECB report in 2018 had a point: Bitcoin’s rise was meteoric, fast and towered over the historic bubbles to which it was compared. The South Sea Bubble looks very modest, not even achieving a 10x gain from the £100 it had hovered around since its creation in 1711. The series for Nasdaq seems wholly out of place, barely tripling over the two years prior to its peak. By picking more concentrated indices, portfolios or individual tech stocks, we could create a higher spike, for instance by using returns of the list of the 400 or so internet companies that was published by Morgan Stanley back then (including Pets.com, eToys and Eggheads as well as more successful ones like Amazon, eBay and Qualcomm). Even then, we barely see companies surpassing 10x returns.

Tulips

Labeling an asset “tulips” seems like the perfect argument: tulips are adornments, with established markets, that are relatively useless and are easily mass produced. No sane person would buy them at extremely high and accelerating prices, which makes any tulip price increase the ultimate evidence of irrational financial markets and the delusions of greedy capitalists.This is why tulips has become a “byword for insanity in the markets,” according to Anne Goldgar, the scholar who has done most to uncover the real history of the 1637 “Tulipmania.”

What we know about the tulip mania is very limited, most of which was popularized by Charles Mackay over two centuries later, almost all of it relying on hearsay, selected extracts from moralizing pamphlets at the time and echoed credulously in our time by the likes of John Kenneth Galbraith and Charles Kindleberger. All had great axes to grind against the insanity of financial markets.

As presented by Goldgar, we have traces of scant trading by merchants and among the gentry of select bulb promissory notes: futures contracts that entitled the owner to a certain bulb once sprouted later that spring. We have archival evidence of a hundred or so different prices for these contracts, with few spot transactions taking place between November 1636 and March 1637, as the bulbs were planted in the ground during the winter months. Goldgar never found more than a few dozen purchases of bulbs at prices exceeding a master craftsman’s wages, and most of these were by well-off merchants who adorned their homes with one-of-a-kind bulbs set next to portraits or other decorations.

A major problem faces the construction of the bubble-like time series that the ECB so carelessly used: bulbs are not identical. Individual types were valued for unique patterns that arose with a mosaic virus that made them “break” — they were non-standard products, the majority of which never fetched any remarkable prices. Peter Garber identifies 16 different kinds of bulbs with a handful of price quotes for each. Based on a pamphlet retold by Dutch historian N.W. Posthumus in the 1920s, Earl Thomson recreated a quality-adjusted price index using a contemporary reference book for tulips. We end up with a dozen data points on a wholly unreliable index over the relevant few months.

Since no spot transactions took place in the critical weeks of early 1637, Goldgar writes that “those who lost money in the February crash did so only notionally… I found not a single bankrupt in these years who could be identified as someone dealt the fatal financial blow by tulip mania.”

The scant quantitative evidence available does not indicate a widespread tulip craze, and neither does the qualitative evidence surrounding the Dutch bulb trade in the 1630s.

The Mississippi and South Sea Bubbles

Compared to the lack of quantitative observations for the Dutch Tulip Bubble, we are awash in them for John Law’s Mississippi scheme of 1719-1720 in France and the South Sea Company Bubble in England the following year. Both of these schemes tried to reduce government debt burdens by converting expensive annuity liabilities into equity in these trading enterprises — aimed at French America for the Mississippi company and Spanish America for the South Sea Company. What little such international trade took place was small-scale, unreliable, often unprofitable and instead the respective schemes became vehicles for financial engineering.

Law’s monetary takeover of the French state started with his establishing a note-issuing bank, Banque Générale, that issued stock in exchange for government bonds that traded below face value. It also promised its depositors to return the same amount of coins deposited, regardless of any devaluation of the currency that might occur, a valuable insurance proposition against monarchs prone to misusing their monetary prerogative. In 1717 the state began accepting the bank’s notes as payment of taxes, firmly establishing Law’s creation in the banking and monetary sphere.

Law organized what became known as the Mississippi Company, owning the monopoly rights to trade on the French lands along the Mississippi River. The company expanded gradually to hold the rights to most of France’s international trade. In January 1719 Law’s bank, now holding lots of government bonds and having issued paper (notes and equity) to fund itself, was taken over by the government and renamed Banque Royale. Later that year, Law merged the financial empire with his trading empire and then effectively became finance minister: he controlled foreign trade, held most of the government’s debt and was in possession of the money printer.

He expanded the bank’s note issuance by 5x in the latter half of 1719, coinciding with a 10x of the price of Mississippi Company stock, which topped out in January 1720. After a heavy sell-off Law restricted gold withdrawals from the Banque, made its paper notes legal tender and promised to exchange these notes for company stock at all-time highs, before repeatedly devaluing the shares in the following month. By the end of the year, prices of ordinary goods had jumped, the Mississippi company stock was back down to where it had been before Law’s bubbling and Law himself fled the country.

The South Sea Company, which began its upward trajectory roughly when Law’s scheme was collapsing, was created almost a decade earlier in a tried and tested way for the British government to reduce its debt expenses: by auctioning off the privilege of amassing government debt. By consolidating many sprawling annuities and other financial debt instruments into equities in a single, easily tradable asset, the Company made servicing the debt easier for the government and the asset more liquid for the creditor.

The first conversion in 1711 swapped new South Sea equity at par for government annuities trading at heavy discounts (an instant profit for the debt holders). Things changed toward the end of the decade: if one could swap some government debt, why not all of it, especially those portions of the debt that the government itself couldn’t redeem? As its shares had sailed above par value of [£]100, any conversion at par would again release instant gains to those handing in their annuities. In the proposals handed to the government in January 1720 the Company diverged from this practice, which allowed the conversion to take place at market price. This, writes Thomas Levenson in a new book on the South Sea scheme, was “the hinge on which all of what was to come would turn.”

Squaring off with the other moneyed firms — the Bank of England and the East India Company — the South Sea Company promised up-front gifts to the government in exchange for the privilege of converting debt while its stock exploded in secondary markets. The higher the stock rose, the fewer shares the company’s directors would have to part with to satisfy the annuitants, while keeping the remaining shares for themselves to sell or lend out later. The parliamentary deal allowed them to swap new shares at market prices, but account for them at par: redeeming £100 worth of government debt with South Sea stock trading at £100 would require the full share, but that same share could redeem twice as much debt if the South Sea stock exchanged hands at £200. Still creating and issuing two new shares, but only having to give up one to satisfy debt holders, the company directors had an extra share to do with as they wished. “The more South Sea shares rose,” writes Levenson, “the more the Company would be worth — which would make shares in such a valuable enterprise still more desirable.”

Over four fund-raising subscriptions during the spring and summer of 1720, the Company effectively created leveraged products as only a part of the stock was paid up front. As the scheme only worked while Company stocks soared higher, new issues weren’t delivered to subscribers until December 1720, preventing sell-offs (due to a lock-up period). Subscriptions were issued at progressively higher prices; The Company lent money to investors with Company stock as collateral; its directors convinced Parliament to ban other joint-stock companies; it closed its transfer books (effectively turning spot trading into futures) for two months at the stock’s price peak, before struggling to pay an outsized dividend. As with many other debt and leverage-fueled schemes, eventually the fuel runs out, and just like leverage increased the power on the way up, its cascading effects of panic-selling exacerbated the downfall. Notwithstanding the Company’s many attempts to keep it afloat, the stock collapsed in the fall of 1720 back to around £130, where it had started the year.

Still, it wasn’t valueless: its fundamental value was not, pace Roubini, zero. After criminal proceedings and restructuring by Parliament, it became a government-bond holding company operating until the 1850s.

Merchants, paupers and half the nobility were obsessed with South Sea stock in the spring of 1720, and at some point the market capitalization of the company rivaled the value of all land in England. That makes it a much more plausible candidate for a financial mania, but would by that same metric exempt bitcoin: its total market capitalization is around a trillion dollars while the world’s equity markets, bond markets and properties have a combined market value of more than a hundred times that. If bitcoin is in a South Sea-style bubble, it has a long way left to go.

If bitcoin had dwindled into obscurity after its December 2017 peak, the arguments by the Krugmans, Roubinis and ECB pundits of the world would make some sense: it does indeed rival the great bubbles of the past, rising to prominence before collapsing (albeit in price movements, rather than economy-wide impact). Those who called victory when bitcoin’s dollar price fell from grace in early 2018 must view what happened next with great inconvenience. Roubini frequently says that the fundamental value of bitcoin is zero yet the price moves further and further away from his long-standing prediction. If I extend the exact same chart to what happened after the ECB’s 2018 report, we get this:

The price of Mississippi stock in 1719 didn’t fly toward the moon so much because of deluded investors or clueless citizens, but because John Law took over the apparatus of the French state, printed endless amounts of money and propped up the Mississippi share prices through buybacks and price guarantees. The South Sea Company bubbled its stock by routinely faking its accounts, bribing MPs, pausing spot trading and getting Parliament to ban competitors.

It’s hard to see this as analogous to Bitcoin. Few bubbles run up like bitcoin and collapse only to return stronger than ever a few years later. It took Nasdaq more than 10 years to return to its prior high, consisting mostly of new companies as well as the successes of the late-1990s. Particular tulips of 1637 fell out of fashion; the Mississippi company was wound down; the South Sea Company returned to its existence as a dull pass-through vehicle for government interest payments. In contrast, the truly flourishing companies to come out of the dot-com era (Amazon, eBay, Apple) have made their investors wealthy, even those who bought at the peak of the bubble.

The claim of those who predict a South Sea Company-like collapse for Bitcoin still have time on their side, and with recent events, even fuel on their fires. But they don’t have history. Reviewing the iconic bubbles to which Bitcoin gets compared, it looks much less like these alleged financial manias and much more like the resilient success stories that came out of the dot-com era.

Jonathan Swift followed the quote above with “That Truth (however sometimes late) will at last prevail.” Let’s hope he’s right.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.